Policy on Corporate Governance

The Board of Directors Meeting of Sermsuk Public Company Limited (“Company”) has approved the Company’s Corporate Governance Policy as follows:

The Board of Directors believes in the principles of good corporate governance and recognizes its importance in strengthening the trust of its shareholders, its stakeholders and the public at large, and increasing shareholder value. The Board of Directors is thus committed to compliance with corporate governance guidelines issued by the regulatory bodies that govern the operations of public companies, and to the implementation of such other standards that are appropriate to the proper conduct of the business of the Company.

Notwithstanding, each board member commits to adhere to the Code of Best Practice for the Directors. Review and scrutiny of the Company’s management has been carried out regularly and honestly to ensure compliance with laws, the Company’s objectives and articles of association, and the resolutions of the shareholders’ meeting, with due care and honesty for the Company’s benefits and responsibilities to the shareholders as required by the Securities Exchange Commission and Stock Exchange of Thailand hat all listed companies apply Principles of Good Governance in their business operations).

The Sub-committees

The Company’s Board of Directors consists of 15 members elected by the resolution of the Shareholders’ meeting as mandated by the Company’s Articles of Association. With extensive knowledge and experience in the business area, the Board of Directors defines the policies, vision, strategies, objectives and business trends for the Company and enables the Company’s management to run the Company’s business in an efficient manner in accordance with the Company’s business objectives. The Board of Directors appoints the Chairman of the Board and the Chairman of Executive Committee & Chief Executive Officer and the President. The Chairman of Executive Committee & Chief Executive Officer is authorized to manage the Company’s business under usual business norms and the direction from the Board of Directors.

A minimum of three Board of Directors meetings are required every month. However, in order to resolve any urgent issues, a special meeting may be called as necessary. The meeting was beforehand dated and informed to each member of the committee throughout the year.

Moreover, the Board of Directors appoints Audit Committee, Nomination and Remuneration Committee, Corporate Governance Committee, Executive Committee and Sustainability and Risk Management Committee.

The Board of Directors exercises its managerial role through the review of management reports made at the Board of Directors meetings as to the Company’s operations and performance, compared to the operating plan and performance of the previous year. Moreover, the Board’s approval or ratification is required for the implementation of important policies and projects, for example, projects involving substantial investment, transactions with related parties, etc.

The Board of Directors exercises its managerial role through the review of management reports made at the Board of Directors meetings as to the Company’s operations and performance, compared to the operating plan and performance of the previous year. Moreover, the Board’s approval or ratification is required for the implementation of important policies and projects, for example, projects involving substantial investment, transactions with related parties, etc.

The Company summarized its compliance status with the Principles of Good Governance 2017 as follows:

- Principle 1 Establish Clear Sustainability Leadership Role and Responsibilities of the Board

- Principle 2 Define Objectives that Promote Sustainable Value Creation

- Principle 3 Strengthen Board Effectiveness

- Principle 4 Nomination, Management Development and People Management

- Principle 5 Nurture Innovation and Responsible Business

- Principle 6 Strengthen Effective Risk Management and Internal Control

- Principle 7 Ensure Disclosure and Financial Integrity

- Principle 8 Ensure Engagement and Communication with Shareholders

- 9. Aggregation or Segregation of Duties

- 10. Directors Fees and Management Remuneration

- 11. Board of Directors’ and Board Committee Meetings

- 12. Sub-committees – several subcommittees are required to screen assignments for the Board of Directors including the Audit Committee, the Nominating and Corporate Governance Committees and the Compensation Committee

The members of the Board of Directors are qualified and experienced individuals who have vision, exercise independence in making important decisions, and set up policies and directions for the benefit of the Company and its shareholders. The Company stipulated that independent directors should not assume the term in office exceeding 3 consecutive terms or a period of 9 years unless they are qualified to hold the position for a longer period.

In this regard, the board realize that to achieve sustainable value creation, the board have exercised their responsibilities and pursue the governance outcome in order to have the better result with long-term perspective, ethical and responsible business.

The board have performed their responsibilities with their duty of care and duty of loyalty and operates the company in accordance with applicable law, Company’s articles of association and shareholders’ resolution.

The board have demonstrated a thorough understanding of the division of board and management responsibilities. The board have defined the roles and responsibilities of management and monitor management to perform their assigned duties.

Moreover, The Company’s operating performance is regularly reported at least on a quarterly basis at the Board of Directors Meetings, and the board is able to review and ask questions about operating performance and the management.

The Board of Directors determine and oversee the objectives that promote sustainable value creation and governance outcomes as a framework for the operation of the company. The Board of Directors also oversee to ensure that the company’s annual and medium-term objectives, goals, strategies, and plans are consistent with the long-term objectives, while utilising innovation and technology effective

Principle 3.1

The board authorized the Nominating and Corporate Governance Committee (“NCGC”) to consider and recommend the board regarding the board structure and the tenure of the board and subcommittees.

The NCGC have responsible for considering the selection of qualified and experienced individuals, the appointment, the removal of the board and subcommittees. The selected directors tend to be persons whose qualification fulfill the committee’s diversity in terms of skills, expertise, gender in achieving the company’s objectives.

The board have disclosed the diversity policies and details relating to directors, including directors’ age, gender, qualifications, experience, shareholding percentage, years of service as director, and director position in other listed companies in the company’s annual report and on the website.

Principle 3.2

The board consists of 15 members comprising of one-third of independent directors. The positions of Chairman of the Board of Directors and the Chairman of Executive Committee are held by different persons. The Chairman of the board is not the employee and Management of the Company to keep checks and balances in place. The Company separates the roles of chairman or management clearly. The approval from the Board of Directors and/or shareholders is required on major and material matters.

The Company realizes the necessity of appointment the non-executive directors and independent directors to balancing the power of executive directors. Therefore, for the year ended 30 September 2019, the Board of Directors consisted of 5 executive directors, 5 non-executive directors and 5 independent directors.

Principle 3.3

The board has set the policy and procedures for the selection and nomination of directors are clear and transparent resulting in the desired composition of the board, the details as set out in 9.3.

Principle 3.4

The board delegates the Compensation Committee to be responsible for setting the policy and compensation structure and proposing the shareholders’ meeting for approval. When considering the policy and compensation structure the committee will consider whether the remuneration structure is appropriate for the directors’ respective roles and responsibilities, linked to their individual and company performance, and provide incentives for the board to lead the company in meeting its objectives, both in the short and long terms.

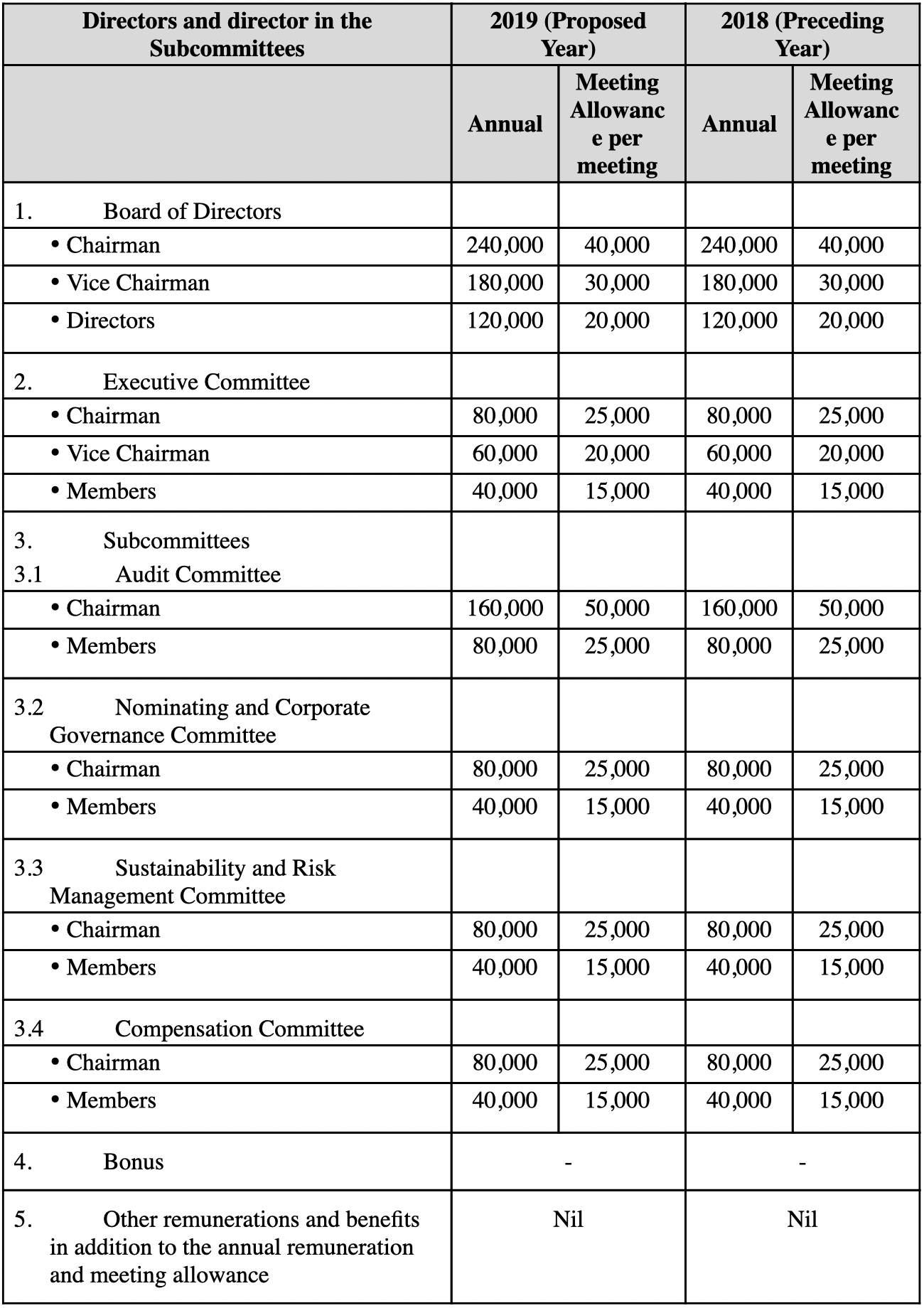

Currently, directors’ remuneration consists of directors’ fees and directors’ bonuses as approved by the shareholders in the 2019 Annual General Meeting held on 8 January 2019, details are as below.

Principle 3.5

The board is required, every three months, to convene a meeting. . The Directors’ meetings are pre-scheduled with notices of the meeting sent out to Directors at least 7 days prior to the meetings. The Chairman of the Board of Directors and Chairman of the Executive Committee jointly proposed the topics of discussion contained in the agendas and opened a chance for other directors or members of the subcommittees to propose their topics for inclusion in the agendas. In each meeting, sufficient time is allowed for discussion. Questions raised by the directors are explained and clarified by the responsible executives. The written minutes of the meetings as approved by the board are maintained for future verification.

For the year ended 30 September 2019, there were 5 Board of Directors’ meetings. Other sub-committee meetings were held as appropriate. For the aforementioned period, there were 4 Audit Committee meetings, 2 Compensation Committee meetings, 2 Nominating and Corporate Governance Committee meeting, 4 Sustainability and Risk Management Committee meetings and 12 Executive Committee meetings with the attendance of directors and members of committees. In the past year, there was 1 meeting of non-executive directors to discuss management issues of concern without the presence of the management.

When the Board of Directors’ meeting can conduct business a minimum of two-thirds of all directors presenting at the time of vote casting is required to form a quorum.

Principle 3.6

The board have set the company’s governance framework and policies of subsidiaries and other businesses in which it has a significant investment as appropriate, details as set out in 9.4.

Principle 3.7

The board is required to do self-assessment, which are 1) self-assessment for all board members, 2) self-assessment of each sub - committee and 3) self-assessment of each individual sit in each sub-committee at least once a year. The principle is in accordance with the sample self-assessment form of the Stock Exchange of Thailand (“SET”), consisting 5 major topics as follows;

- structure and qualification of the directors;

- roles and responsibilities of the directors;

- the Board of Directors’ Meeting;

- relationship with the management; and

- self-development and the managements improvement.

The forms are used by the directors to assess the performance of the board. For the performance assessment of the sub-committees, the self-assessment form having principles similar to the aforementioned topics in accordance with those stipulated by the SET . These 3 self-assessment forms are sent by the Company Secretary to all members of the Board of Directors to evaluate themselves. After being filled, the self-assessment forms will be collected and concluded for the results that indicate the overall operations of the board, each of group committee and each member of group committees, that will be later announced in the meeting of the board.

Moreover, the Company conducts a formal annual performance evaluation of the President in the areas of leadership, strategy establishment, strategy execution, planning, financial performance, and relationship with the board. The assessment results can be used to enhance the efficiency in the performance of the President, in alignment with the Company’s business direction.

Principle 3.8

The board encourages and facilitates the board and all directors to understand their roles and responsibilities the nature of the business, the company’s operations, relevant law and standards, and other applicable obligations by way of attending courses , organized by the Thai Institute of Directors (IOD), SET and other institutes, for enable them to improve their skills, knowledge and performance.

Principle 3.9

The board monitor the management to perform their duties effectively and allows each board member and members of sub-committee topropose and the add relevant matters in the meeting agenda. Furthermore, the board allows all directors to access information as necessary from the relevant directors and/or management.

The board appointed a company secretary with necessary qualifications, knowledge, skills, and experience to support the board in performing its duties according to the relevant law and regulations.

The board authorized the NCGC to consider and ensure that a proper mechanism is in place for the nomination and development of the President and key executives in order to possess the knowledge, skills, experience, and characteristics necessary for the company to achieve its objectives.

The board should prioritize and promote innovation that creates value for the company and its shareholders together with benefits for its customers, other stakeholders, society, and the environment, in support of sustainable growth of the company.

The Company recognizes the Stakeholders’ rights and the protection of their interests in the Company as per the following policies:

Shareholders :

The Company is aware of the responsibility to increase the shareholders’ benefit and provide sufficient information on the Company’s operations and performance to all shareholders. With this objective, the business operations of the company have been conducted carefully and transparently in order to increase sales, profits and financial strength. The Company has also continuously improved its business processes to increase operating efficiency and cost control, which has resulted in better performance.

The Company commits to promote and facilitate shareholders including institutional investors to take part in the general meeting of shareholders. The Company will select a venue where it is easily accessible to mass transport system. Also, the Company will ask shareholders to submit their documents prior to the date of the meeting in order to save time for relevant documents to get certified on the date of the meeting. At the venue of meeting, the Company will arrange a convenient registration procedure for general shareholders and institutional investors by means of optimizing the barcode decoder to register and to cast vote with fastness and accuracy. The Company will also provide the stamp duty for some shareholders who are submitting a proxy.

The Company is aware of and provides top priority on Safety, Occupational Health and Environment on the business operation. The board has strongly emphasized in developing an efficient management system on Safety, Occupational Health and Environment for our associates to be more efficient with a view to improve health quality and bring the organization to pursuit the excellence whereby focusing on framework, projects and activities to reduce an injury at work to zero.

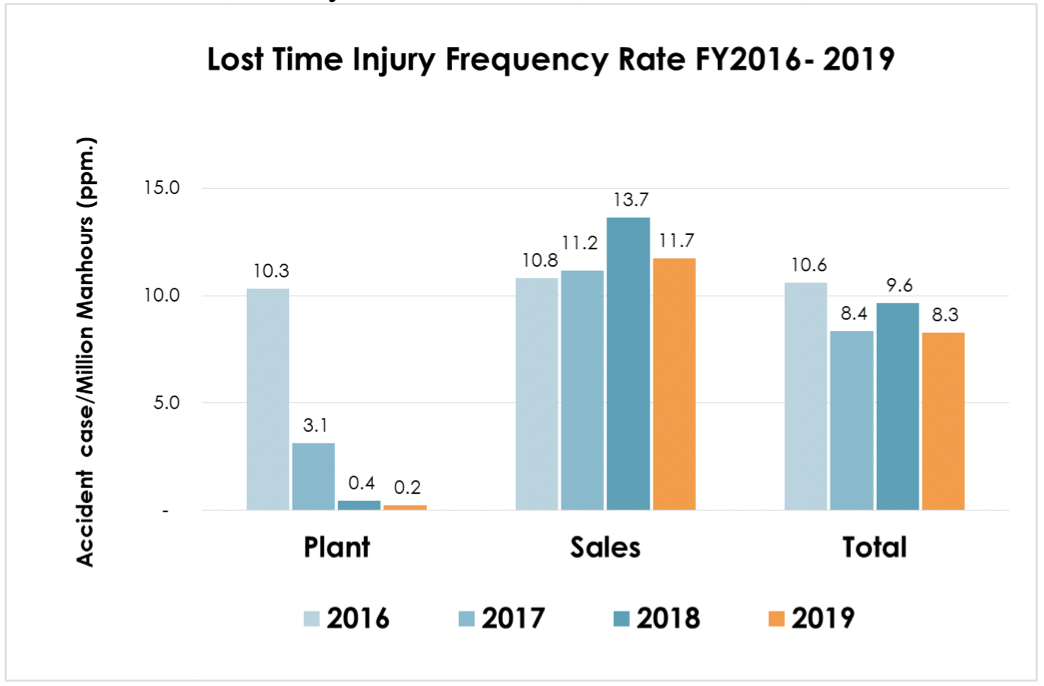

The Company has defined the safety policy and regulation in 10 components as well as has determined the key safety performance indicators (KPI) for employees. Emphasis is placed on projects and activities designed to bring awareness to the importance of safety among the employees including provision of tools, equipment and essential resources to reduce the accident rate, in strictly compliance with the applicable standard of Safety and Occupational Health and Environment and other legal requirements to ensure the incident-free of our employees and property. In 2019, our total Lost Time Injury Frequency Rates (LTIFR) at the plants and sales function have been reduced continually as follows :

The Company realizes the importance of customers and consumers’ rights to receive good quality products at a fair price, including product trial opportunities and the benefits from sales promotion campaigns. The Company has established an active system to receive customer complaints regarding products and services, providing quick responses and corrective actions

Suppliers, Business Partners, and Service Providers :

The Company has a purchasing policy for suppliers to allow open bids, in order to ensure a fair deal based on good quality products and services at a reasonable price. As for competitors, the Company is committed to free trade and fair competition according to the law.

Creditors :

The Company treats each group of creditors equally, fairly and transparently and honors the collateral related terms and the contractual obligations agreed with creditors. The Company shall not dishonestly conceal information or facts which may prejudice the creditors. Moreover, the Company properly manage its cash liquidity to ensure compliance and punctual repayment. In case of payment default, the Company shall inform the creditors in advance to jointly solve the problem with the creditors.

Community :

The Company realizes its role in contributing to community development, carrying out numerous socially-responsible activities and projects in collaboration with the community and society. For the year 2019, the Company participated in projects dedicated to promoting sustainable social and community responsibility among industrial plants organized by the Department of Industrial Works, Ministry of Industry. The achievement of the CSR-DIW Continuous Award has demonstrated the Company’s commitment to social responsibility toward the community in accordance with the standards set forth by the Department of Industrial Works. The endeavors have gained the community’s trust and confidence in the Company’s business operations, leading to a sustainable coexistence among the plant, the community, and the environment.

Environmental Protection :

The Company recognizes the importance of environmental protection and actively participates in environmental protection and energy saving programs to prevent air and water pollution and manage unused materials by using ‘Clean Technology’ and the 3Rs (Reduce, Reuse and Recycle) concept in all of its manufacturing and distribution procedures. The Company has operated under the 5 Sermsuk Green Dimensions which are water, packaging, energy, environment and human resources and support the data to Thai Beverage Public Company Limited (“ThaiBev”) enabling ThaiBev to determine its DJSI (Dow Jones Sustainability Indices) score, an index which indicates the effectiveness of business operation based on sustainability guidelines as the global leading company.

The Company has broadened its environmental activation to the public by being a model of environmental conservation and protection for society and other enterprises, aiming to form a major force that drives environmental awareness in Thai society and social development in Thailand and allows the Company to grow alongside a good environment in a sustainable manner.

The board monitor the company to has effective appropriate risk management and internal control systems. The audits of the Company’s operations are conducted by the internal audit team that works closely with the system’s development team to implement policies and procedures for good internal control and effectiveness of the operations of all units. The audit findings together with audit recommendations are reported to the Chairman of Executive Committee after completion of the audit, and reported to the Audit Committee on a quarterly basis. In the event that any misconduct or any breach of policy or procedure of the Company or any breach of law or corporate governance has been found, internal auditor will provide report and suggestion to the relevant department.

Other duties of the audit team are to evaluate the internal control run by each departments and propose recommendations on what needs further improvement to related agencies. Moreover, the Company’s system’s development and management team is responsible for improving operating procedures to enhance the efficiency in coordination and cross-checking assignments among departments in the Company.

The board assigns the Audit Committee and Sustainability and Risk Management Committee to determine, filter and be responsible for controlling system and report the opinion to the board and shareholders related to a sufficiency of the internal control of the Company. The Committee has been assigned to stipulate strategies, policies and objectives to manage risk for the entire Company and to provide guidelines for the management to enable more efficient risk management and to develop the Integrated Risk Management principles for all major risk factors the Company is confronting including business risks,operational risks, financial risks and compliance risks

The board establishes Audit Committee which comprises at least three directors, all of whom must be independent directors, with required qualifications, and complies with applicable legal requirements, including those promulgated by the Securities and Exchange Commission and Stock Exchange of Thailand. The board should clearly set out in writing the audit committee’s duties and responsibilities in the charter of Audit Committee.

The board undertakes that the Company has procured mechanism or tools which enable Audit Committee to access information necessary that allows the Audit Committee to fulfil its duties and responsibilities, including by having access to management, employees and staff, or by consulting with account and finance related staffs, by seeking professional advices from the professional advisers, . The board should ensure the designation of an internal auditor or establish an independent internal audit function that is responsible for reviewing and improving the effectiveness of the risk management and internal control systems, and reporting review results to the audit committee. The result of the internal audit review must be disclosed in the company’s annual report.

The board realizes the need for the independence of the board members and management, to prevent any conflict of interest between the Company, management, board members or shareholders, and to strictly comply with the direction and regulations of the Securities and Exchange Commission and the Stock Exchange of Thailand – in particular, conflict of interest regarding connected persons from connected transactions or the conflict of interest of an employee from his area of responsibility. The Company’s Code of Conduct for Directors provides that at a Board of Directors’ meeting. Directors and executives are required to report their interest as required by the law and those who have an interest in any item on the agenda will not be allowed to attend the meeting during the discussion of that matter and will not be entitled to cast vote. In addition, policies and methods were determined to prevent executives and related persons to exploit the insider information for personal gain.

The board has established an information security system, including appropriate policies and procedures, to protect confidentiality, integrity, and availability of business information, including market-sensitive information. Besides, the board has monitored the implementation of the information security policies and procedures and the adherence to confidentiality requirements by directors, executives, employees and staffs, along with the relevant third parties.

The Company commits to business ethics throughout its operations by cooperating with governmental agencies and ensuring compliance with laws and regulations. The Company provides the Code of Conduct for Directors and the Employee’s Code of Conduct contain specific provisions in this respect with annual reviews and written acknowledgement by the Company’s management and section head of functions.

The Company has set itself an obligation to clearly show transparency in the organization and respect for the law by implementing anti-corruption measures including support activities to encourage Directors and all employees to comply with legislation and relevantregulations. The Company is obliged to not only prohibit the use of any fraudulent measures to make a profit, but also to reject any success resulting from any non-transparent or corrupt actions. Consequently, the company has introduced the following anti-corruption measures:

- Risk Management and Corruption Risk Management Analysis by identify the risks and cause of misappropriation then initiate protection mechanism by strategize and limit timeframe to follow up with Corruption Risk, including continue to operate under Anti-Corruption Policy.

- Initiate the follow up protocol to analyze the result of operation under Anti-Corruption Policy.

- Enhancing reliability by acting professionally to ensure bribery and corruption does not take place, and making a strong commitment to anti-corruption prevention policies.

- Promoting standards, awareness, values and attitudes to employees to act fairly and with integrity, including arrange anti-corruption seminar.

- Enhancing and maintaining the effectiveness of anti-corruption measures. Supporting effective checks and balances as well as providing communication channels for disclosing corruption, measures for protecting informants and fair investigation of suspected corruption and to create confidence among all interested parties that they shall be protected from persecution or mistreatment as a result of filing a complaint or whistleblowing made to the group of companies.

- Facilitating employees, business partners and stakeholders in exposing any illegal or unjust practices via the company's channel of disclosure (whistle blowing) at Sermsuk Public Company Limited, Legal Office, No. 90 CW Tower, 31st – 32nd Floor, Ratchadapisek Road, Huai Khwang Sub-District, Huai Khwang District, Bangkok 10310, Telephone No. 02-783-9000 and email SSC-whistleblowing@sermsukplc.com Notwithstanding, when a whistle is blown ,the Office of Legal Affairs will report the matter(s) arisen to the Company’s Audit Committee on quarterly basis, then will take action (s) necessary.

- Commitment to anti-corruption efforts by supporting or forming alliances with other anti-corruption prevention activities, bodies and approaches.

The Company values the importance of internal controls in protecting it from possible damage. The Company sets clear objectives, operating plans, strategies, and procedures as operating and measurement tools.

To ensure a good internal control and audit system, the Audit Committee is assigned to make regular assessments to the Company’s internal control system, at least once a year, and to report the findings to the Board of Directors after each assessment.

For the year ended September 30, 2019, the Audit Committee assessed the Company’s internal control system by questioning and having discussions with management. Such assessment revealed that the Company had sufficient internal controls over the 5 major parts of its operations, namely, the organizational structure and environment, risk management, control over management, operations, information technology and communication, and follow-up procedures.

Organizational Structure and Environment

The structure and operating environment of the Company promotes effective operations and sufficient internal controls. Clear segregation of role and responsibility creates a check and control system in each department . Operating manuals and procedures ensure standard practice in each of the operating units. Sub-system process and reduction of double work are reviewed regularly for efficiency improvement. The Company also sets clear and attainable annual targets and undertakes measurement of results, taking into account all variable factors such as the economic situation, market conditions, competition and clear standard working evaluation.

Risk Management

The Company closely follows the changes in risk factors such as taxation, increase in raw material prices and other costs, in order to assess the impact and set up action plans for the survival of the business. The Company holds meetings with its management and employees on a regular basis to communicate the situation and the impact of external risks influencing the Company’s operations the cost and profitability of the Company and continuously sets up internal rules and regulations to minimize the impact of those risks. In each operating unit, the head of the unit is responsible for risk management and prevention in his/her own unit.

Management Control

The Company sets clear responsibilities, duties, and authorization of the management emphasizing the segregation of duties for authorization, recording, and safeguarding of assets. Transactions with major shareholders, directors, and management require approval from the Board of Directors and the approval director shall not have conflict of interest in the authorized transactions and to ensure the greatest benefit to the Company. The Company has an operating manual of authorization limits and approvals, and has set up a physical asset verification procedure to ensure the completed count on every item is done within three years and there is a sample count by the internal audit function to reconcile with the fixed asset register and accounting record.

Information System and Communication

The Company submits sufficient and accurate information necessary for Board of Directors’ decisions. Record keeping and accounting transactions are prepared according to recognized accounting standards, and are audited and reviewed by the Audit Committee and the external auditors.

The Company initiates operational policies in relation with intellectual property and copyright infringement. According to the intellectual property policy, all employees are committed to sign the act not to committing computer and intellectual property infringement. Consequently, the company comes up with the clear policy of Information System and Communication and the monitoring of the employees' software to check for violations of company policy against copyright infringement and inappropriately using workplace computers.

Follow-up Procedures

The Company monitors its performance compared to its objectives and reports the results at the Board of Directors’ meetings 4 times a year. In the event of material change of business operation, the Company will provide new plan in consistent with such change.

The board must ensure the integrity of the company’s financial reporting system and that timely and accurate disclosure of all material information regarding the company is made consistent with applicable requirements and ensure that any person (including chief financial officer, accountant, internal auditor, company secretary, Investors Relation officer) involved in the preparation and disclosure of any information of the company has relevant knowledge, skills and experience, and that sufficient resources, including staff, are allocated.

When approving information disclosures, the board consider all relevant factors, including for periodic financial disclosures, the evaluation results of the adequacy of the internal control system, the external auditor’s opinions on financial reporting, observations on the internal, control system, and any other observations through other channels, the audit committee’s opinions and the Consistency with objectives, strategies and policies.

The board disclose information (including financial statements, annual reports, and Form 56-1) reflect the company’s financial status and performance accurately and fairly. The board also promote the inclusion of the Management Discussion and Analysis (MD&A) in quarterly financial reports in order to provide to investors more complete and accurate information about the company’s true financial status, performance and circumstances.

For disclosures related to any individual director, that director should ensure the accuracy and completeness of the information disclosed by the company.

The board monitor the Management ensure that management regularly monitors, evaluates and reports on the company’s financial status. Furthermore, the board and management will ensure that any threats to the company’s financial liquidity and solvency are promptly addressed and remedied. However, in the event of financial risk or difficulties, the board will promptly identified, managed and mitigated, and that the company’s governance framework provides for the consideration of stakeholder rights.

The board should provide appropriate Sustainability report on the company’s compliance and ethical performance (including anti-corruption performance), its treatment of employees and other stakeholders (including fair treatment and respect for human rights), and social and environmental responsibilities, The company shall disclose material information to reflect the sustainable value..

The board established the dedicated Investor Relations function responsible for regular, effective and fair communication with shareholders and other stakeholders.

In addition, the company hold a factory visit,a press conference regarding the performance and business direction and arrange meeting withthe investors and analysts. Throughout the meeting the Company assigned the designated person to disclose information to investor, analysts and interesting persons as requested.

In addition to the company’s mandatory periodic and non-periodic disclosure of information pursuant to applicable requirements via channel of Stock Exchange of Thailand, the board also facilitate technology for disclosure the relevant information in both Thai and in English via the company’s website.

The board encourages shareholders to exercise their legal rights, such as rights to receive their share of profits in the form of dividends, rights to freely purchase or transfer the Company’s stock, rights to access the Company’s news and information, rights to attend and vote in the shareholders’ meetings.

To ensure shareholders’ right to equally access to updated news and information, the Company consistently announces its operating results and important information to the shareholders via the Securities Exchange of Thailand and on the Company’s website.

The Company has been committed to supporting shareholders and institutional investors and facilitating their participation in the shareholders meeting. As such the venue of the meeting will be chosen by the Company with a focus on its location being accessible to adequate public transportation for the convenience of shareholders.

Principle 8.1

The board encourage the shareholders to participate effectively in decision-making involving significant corporate matters pursuant to applicable legal requirement and corporate matters may affect the business operation by giving the opportunity to considered and/or approved by the shareholders. Matters that require shareholder approval should be included in the agenda for the shareholders’ meeting.

The board also encourage the participation of shareholders by giving the opportunity to propose agenda for shareholders’ meetings and the list of persons for consideration to be elected as directors of the Company at the Annual General Meeting of Shareholders in advance. This is toin comply with the principle of good corporate governance and to ensure the shareholders' right and fairness treatment. The proposal should comply with the criteria of the foregoing matter which will be announced in the Company’s website. However, in the event that the board rejects a proposal,the board shall inform the shareholder’s such rejection with reasons’s given. .

For the year 2019, The Company had provided the shareholders an opportunity to propose an agenda and the list of persons for consideration to be elected as directors in advance via the Company’s twebsite from 18 October 2019 to19 November 2019. However, there was no shareholder proposing an agenda to be considered at the 2020 Annual General Meeting of Shareholders./p>

For each shareholders’ meeting, the Company will send shareholders an invitation letter at least fourteen days before the meeting, setting out the meeting agenda and including the supporting documents (via the Company Registrar), so as to provide Shareholders enough time to review the detailed information. The invitation letter and other Annual General Shareholders’ Meeting materials will also be announced on the Company’s website. The Company also publishes the Shareholder invitation letter in a daily newspaper, both Thai and English, at least 3 consecutive days before the meeting.

Principle 8.2

The board will ensure that the shareholders’ meetings are held as scheduled and conducted properly, with transparency and efficiency, including ensure that all shareholders areable to exercise their rights in the shareholders’ meeting. For the convenient of shareholders and institutional investors, the boardshould allocate sufficient time for answering any queries of business operation of the Company. Directors, chairman of sub-committee shall participate the meeting to answering the queries of shareholders.,

The board ensure that there is no limited the right of shareholders to participate shareholders’meeting or there is too burden incurred to shareholders.

Also, the Company will ask shareholders to submit their documents registrated prior to the date of the meeting . And promote computer technology and barcode system to registrating and voting with fastness and accuracy of the meeting.

The chairman of the board is the chairman of the shareholders’ meeting. Hewill responsible to monitor the meeting to be compliance with applicable legal requirements and the company’s articles of association, allocate sufficient and appropriate time for eachof agenda , and provide opportunity to all shareholders who wish to share their opinions or ask questions related to the company.

To ensure the right of shareholders to participate in the company’s decision-making process in relation to significant corporate matters, directors who are shareholders should not be supported to add any agenda that have not been duly notified in advance especially, the significant agenda that shareholders should spend time prior to making any decision.

All directors and relevant executives should attend the meeting to answer questions from shareholders on company-related matters.

The attending shareholders should be informed of the number and the proportion of shareholders and shares represented at the meeting in person and through proxies, the meeting method, and the voting and vote counting methods before the start of the meeting. There should not be any bundling of several items into the same resolution. For example, the appointment of each director should be voted on and recorded as separate resolution.

The board should promote the use of ballots for voting on resolutions proposed at the shareholders’ meeting and designate an independent party to count or to audit the voting results for each resolution in the meeting, and to disclose such voting results at the meeting. The voting results for each proposed resolution should be included in the minutes of the meeting.

Principle 8.3

The board will ensure that the company discloses the results of voting on proposed resolutions at the shareholders’ meeting through the designated Stock Exchange of Thailand channels and through the company’s website by the next business day. Furthermore, the board should ensure that minutes of the shareholders’ meeting is accurate, comply with good corporate governance and is submitted to the Stock Exchange of Thailand within 14 days from the shareholders’ meeting date.